Lubartów, November 2019

City wallet with compartments

And in it our money

The City Council is about to start working on the city's budget for 2020.

We know that many residents do not feel that their wallet is related to the same budget. The city gets some money from the state, we pay some taxes on the spot and it turns out somehow ...

How much does the City Council plan to have in its portfolio in 2019? She assumed that we will have approx. PLN 106 million in income. Where exactly this money will come from, you will find in the budget resolution.

However, there is an item that is closely related to our work, and these are income tax receipts from natural and legal persons. What exactly is this?

All residents who pay tax on their salary or business activities - contribute to the city's budget in this way. In 2019, it is approx. PLN 23 million, i.e. as much as one fifth of the city's income, is our labor taxes .

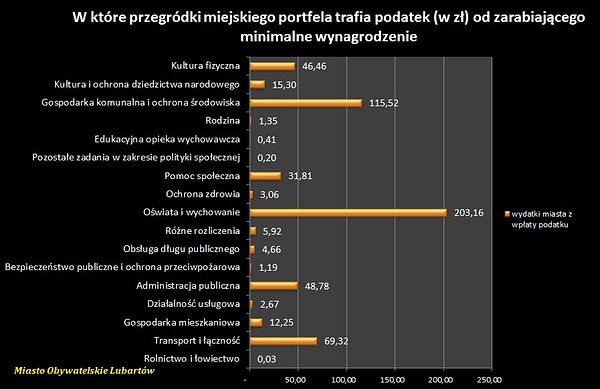

Suppose a resident earns the minimum wage (PLN 2,450). He will pay a tax of PLN 1,476 on this salary in 2019. About 40% of this amount goes back to the city budget, in the case of personal income tax, i.e. everyone earning the minimum wage will transfer to the city about PLN 526 this year.

What does the city spend them on?

We take into account the structure of expenses for own tasks, because, as you know, the shirt is closer to the body.

_jp.jpg)

This is, of course, a simplification. And someone will say, and what is this "paltry" PLN 22,879,406.00 of taxes on natural and legal persons ...

In the chart, calculate only for impact from payroll tax.

The authorities expect that we will also bring income to the city from other sources, because residents also pay tax on real estate, means of transport, etc. The plans concern:

- real estate tax PLN 12,050,000.00,

- agricultural tax PLN 66,200.00,

- tax on means of transport PLN 610,000.00,

- tax on inheritance and donations PLN 70,000.00,

- tax card PLN 90,000.00,

- stamp duty PLN 320,000.00,

- fair fee PLN 50,000.00,

- permits for the sale of alcoholic beverages PLN 500,000.00,

- other local fees PLN 380,000.00,

- tax on civil law transactions PLN 775,000.00.

This is the total amount of PLN 37,790,606.00. Not a fifth, but more than a third of the planned income.

That is why it is so important to be aware that this is not abstract money, but money that each of us co-finances roads, schools or the maintenance of sports facilities. And which, on our behalf, are managed by the City Council and the Mayor.

Therefore, traditionally, we encourage you to contact the councilors if anyone wants to know more.

After all, they are about to decide how they will spend our money next year.

Work for those willing. If you earn more than the minimum wage, then calculate 38.08% of the annual tax rate and that will be the amount that returns to the city. How long will you have to date for each item - calculate according to the chart.